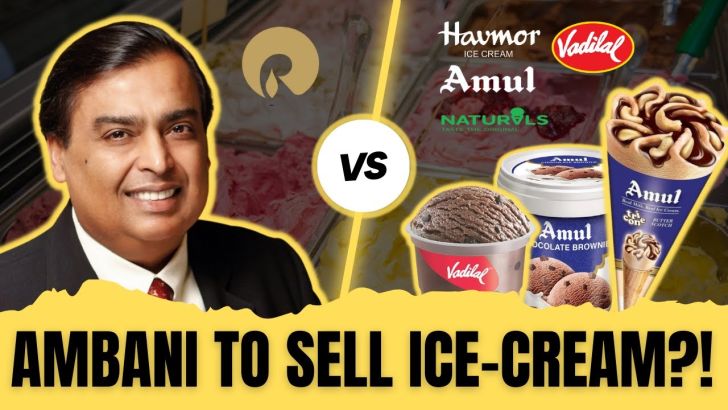

The most valuable corporation in India, Reliance Industries, plans to go into the booming ice cream industry. The fast-moving consumer goods (FMCG) market is where Reliance is putting more of its attention recently. Reliance is negotiating with a Gujarati firm to start making ice cream. Competition in the Indian ice cream industry may intensify as a result of Reliance’s entry, say market analysts. Over Rs 20,000 crore (about $3 billion) is at stake in India’s ice cream industry right now. Half of this is contributed by the formal economy. Reliance has not yet made any public statements on its planned foray into the ice cream market. Reliance plans to enter the fast-moving consumer goods market with new offerings. According to reports, negotiations with the ice cream manufacturer in Gujarat are nearing completion. This summer might see the introduction of Reliance’s ice cream line.

RIL Planning on Stealing the Summer

When RIL entered the cola market, it made a lot of people nervous.

It’s as though it suddenly wants to ruin every part of summer. Consider Reliance this summer.

Therefore, it intends to compete in the Indian ice cream market and the Indian frozen food market more generally.

According to rumors, the company would introduce ice cream under its recently introduced budget-friendly FMCG brand, Independence. Talks to begin production are reportedly underway with a factory in Gujarat. It’s really intriguing that the company has chosen Gujarat as the base for the introduction of its ice cream and frozen food brand. Why?

RIL’s Entry into the Cola Market Already Has People Sweating, and Now They Plan to Steal the Summer.

The Choice of the Battle Ground

- Simply said, Gujarat cries out for frozen treats.

- It’s responsible for 11% of India’s ice cream sales ($1.3 bn). Gujarat is home to some of India’s finest ice cream factories.

- And, RIL was originally founded in Gujarat.

- However, Gujarat has the potential to be both the most profitable and the most challenging market to enter.

- Let’s start with the Amul dare.

- Amul, India’s largest ice cream manufacturer, has its roots in the state of Gujarat.

- But RIL could theoretically compete with Amul.

- After all, they’ve enlisted the help of Amul’s former MD, RS Sodhi.

- While at Amul for 12 years, Mr. Sodhi increased annual sales from Rs 9,774.27 crore in FY11 to Rs 46,481 crore in FY22.

- In addition, RIL’s entry into a market always results in dramatic price shifts.

- This may be Amul’s Achilles’ heel at the moment. Now is not the time for a pricing war.

Why?

-

Because manufacturing expenses are on the rise.

-

Milk prices are extremely expensive because of the high cost of cow feed and the decrease in production caused by lumpy skin disease.

-

And Amul has been charging customers for this.

-

People may switch brands if RIL enters the market with cheaper ice creams.

-

The second obstacle is the unregulated gambling scene in Gujarat.

-

This is certainly going to be a difficult task.

-

Many unregulated ice cream shops have sprouted up in Gujarat to meet the demand created by the state’s ice cream fanatics.

-

These companies are always coming out with new and interesting ice cream flavors, from mango barfi ice cream to paan ice cream to even garlic ice-cream (seriously)!

-

Organized players like Havmor and Vadilal are always releasing new flavours to meet the ever-increasing demand in Gujarat.

-

Currently, Havmor offers over 160 flavors, with three new ones introduced every quarter.

-

The ice cream market in Gujarat is, surprisingly enough, rather competitive.

Let’s back up a little and consider RIL’s potential on a national scale.

It has been stated that only Reliance-owned stores would carry the ice cream. The Independence brand is already used by the corporation to offer edible oils, pulses, cereals, and packaged goods. The introduction of Reliance into the ice cream market has the potential to significantly alter the industry and boost levels of competitiveness. There is currently no information available about the company’s intended product offerings or target markets.

The ice cream industry in India is worth an estimated Rs 20,000 crore. Half of this is contributed by the formal economy. In the next five years, the Indian ice cream market is predicted to expand by double-digit percentages. The need for it is growing even in more remote regions. More businesses entering the market is a possible outcome under these conditions. Because of this, there will be more rivalry.

Rupinder Singh Sodhi, formerly the managing director of Amul, was recently hired by Reliance Retail Ventures Limited, where he may assist the firm to strengthen its position in the dairy industry. For the past 41 years, RS Sodhi has helped the Gujarat Cooperative Milk Marketing Federation establish the Amul brand of milk as a household name across India. RS Sodhi reportedly helps run Reliance’s food division after leaving GCMMF in January. However, the team may also benefit from his knowledge and experience while developing its dairy product.

In addition to RS Sodhi, Reliance has brought on Sandipan Ghosh to lead the dairy and frozen products division at Reliance Retail. Milk Mantra and Lactalis India are two companies he has worked for in the past.

This is the organization’s second effort to get into the dairy industry. In 2016, the Reliance group sold its dairy business to Heritage Foods and left the industry.

India’s dairy industry is thriving, and it’s just going to keep expanding in the years to come. Reliance Industries’ goal is to take advantage of the expanding market.

Reliance has recently reintroduced its Campa brand and expanded into the personal and home care sector of the fast-moving consumer goods industry. The collective’s goal is to sell its wares at a 30%-35% discount.

According to the article, Reliance wants to go head-to-head with established dairy companies like Amul and Mother Dairy. According to the article, the corporation plans to make many strategic acquisitions in the value-added sector of the industry as part of its massive development strategy.

According to insiders, discussions with the Gujarat-based ice cream producer have reached a final stage, and the business plans to introduce its ice cream this summer through its specialized grocery retail locations.

Products under the Independence label include cooking oils, pulses, cereals, and processed meals.

An industry insider predicted that Reliance’s arrival will have a profound impact on the ice cream industry and increase competitiveness. It will be fascinating to observe the breadth of its offerings and the kind of customers it seeks to serve. More than Rs 20,000 crore is spent annually on ice cream in India, with around half of it going to organized players. As disposable income rises and more people gain access to electricity, the ice cream industry in India is predicted to expand by double digits over the next five years. There has been a dramatic increase in the demand for ice cream in rural areas, leading us to speculate that other large corporations may soon enter the industry. To meet rising demand, ice cream producers including Havmor Ice Creams, Vadilal Industries Ltd, and Amul are increasing production.